After more than a decade of yields sitting well below historical averages and often close to zero for shorter maturities, treasuries have been relatively unattractive investments for quite a while. Recently, however, the market environment for all fixed income has changed dramatically as yields rose to their highest levels since 2007. Investors rotated into short-term treasuries—those maturing in under three years—with astounding alacrity and short-term treasury ladders surged in popularity. Although purchasing shorter-term treasuries may seem like a “safer” approach, as with any investment, there are inherent risks. Here, one of the most significant is reinvestment risk.

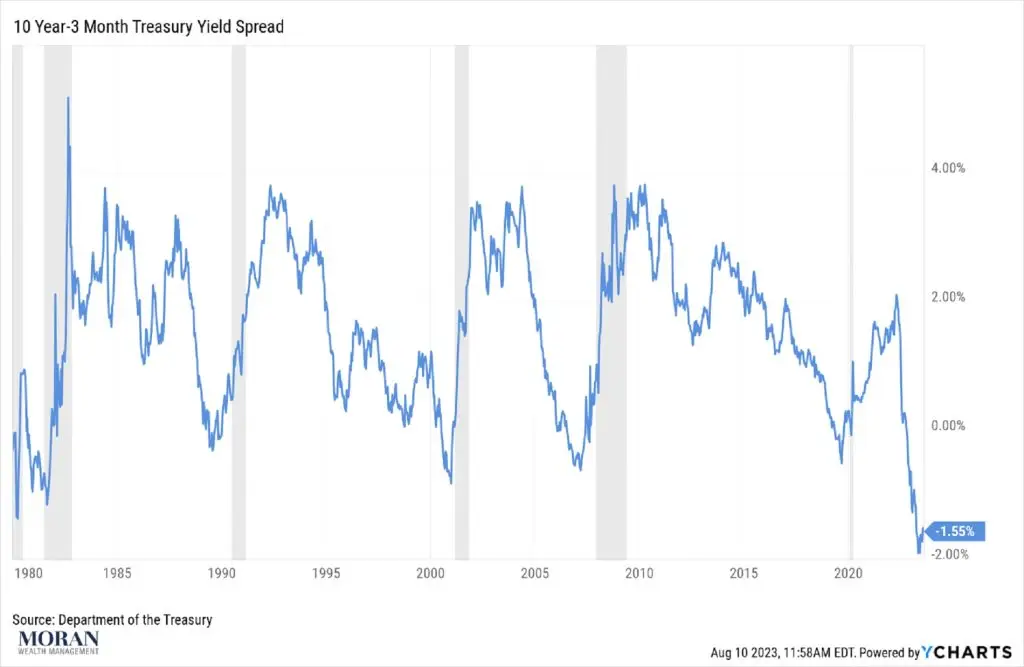

In 2022 alone, short-term treasuries and short duration Exchange Traded Funds (ETFs) saw record inflows of over $70B for the year. In comparison, the same group of ETFs have seen approximately $8B of outflows so far this year. How can we explain this? As indicated by the chart below, we are currently experiencing the most inverted yield curve since the 1980s, which is usually a signal that the market expects rates to be lower in the future. That said, investors appear to be shifting the duration of their investments rather than fleeing the asset class entirely..

With longer tenors also comfortably outpacing inflation, intermediate duration (3-10Y) ETF strategies have seen consistent inflows totaling over $49B over the course of the past 12 months. These observations lead us to believe that the market is anticipating a future normalization of the yield curve as the Federal Reserve halts or greatly slows the pace of rate increases; perhaps cutting them should the economy slide towards a recession.

Many investors, however, are still purchasing ultra short-term treasuries fully expecting their attractive yields to continue into the foreseeable future—often without realizing that the quoted yields are annualized while the security matures sooner than one year. The downside of purchasing such short-term treasuries is that it matures so quickly, and another investment must be found and purchased to replace it. In a rising interest rate environment, this flexibility can be advantageous; less so in a falling one. That is what financial professionals call reinvestment risk.

With indications of a peak in interest rates approaching, we would advise that clients lock in current rates, minimize reinvestment risk, and extend the duration of their fixed income portfolios by purchasing longer-term treasuries and quality investment-grade corporate bonds.

Authored by:

Arian Mirfakhraee – Portfolio Manager & Patrick Moran – VP of Corporate Strategy, Portfolio Manager

Manager Moran Wealth Management®

as of 8/29/2023

This letter is solely for informational purposes and is not an offer or solicitation for the purchase or sale of any security, nor is it to be construed as legal or tax advice. References to securities and strategies are for illustrative purposes only and do not constitute buy or sell recommendations. The information in this report should not be used as the basis for any investment decisions. To the extent that the recipient has any questions regarding the applicability of any information discussed herein to their specific portfolio or situation, the recipient should consult with the investment, tax, accounting, and/or legal professional of their choosing.

We make no representation or warranty as to the accuracy or completeness of the information contained in this report, including third-party data sources. The views expressed are as of the publication date and subject to change at any time.

This document is being furnished on a confidential basis and is for the use of its intended recipient only. No portion of this document may be copied, reproduced, republished, or distributed in any way without the express written consent of Moran Wealth Management®.

Moran Wealth Management® (MWM) an SEC registered investment adviser located in Naples, Florida. Registration as an investment adviser does not imply a certain level of skill or training.

Moran Wealth Managementt® is a separate entity and not affiliated with any other entity or practice that uses the same name.

A copy of MWM’s current written disclosure statement as set forth on Form ADV, discussing MWM’s business operations, services, and fees is available from MWM upon written request using the contact information contained herein or visit advisorinfo.sec.gov.