The Federal Reserve announced a 25-basis-point cut, lowering the federal funds target range to 4.00%–4.25%. While this marks the first rate cut since December 2024, many investors were anticipating a larger move. For clients and households, the implications are meaningful—but also complex.

At Moran Wealth Management®, we aim to look beyond the headlines and provide measured insight into what this decision means for your financial life.

Why the Fed Cut Rates

The Federal Open Market Committee cited a combination of factors for its decision:

- Slowing job growth and signs of a cooling labor market

- Inflation that remains elevated, despite showing some moderation

- Economic growth that has decelerated from earlier pace

As Charles E. Chesebrough, Jr., CFA, Managing Director and Head of Quantitative Strategies, explains:

“The Fed judged that downside risks to employment have increased. Inflation remains somewhat elevated, and economic growth has moderated—this made a 25-basis-point cut the prudent move.”

Notably, one Fed governor dissented, preferring a larger 50-basis-point cut. And while this was a modest adjustment, the Fed’s own projections—the “dot plot”—signal two more rate cuts are possible this year.

What It Means for Your Wallet

- Borrowing costs may ease modestly for mortgages, home equity loans, and credit cards.

- Savings rates on money markets and CDs are likely to step down, though still attractive by historical standards.

- Currency effects may follow: a softer Fed often leads to a weaker U.S. dollar, which can ripple through international investments and travel budgets.

In short, households will see small but noticeable shifts, especially if more cuts follow later this year.

What It Means for Your Portfolio

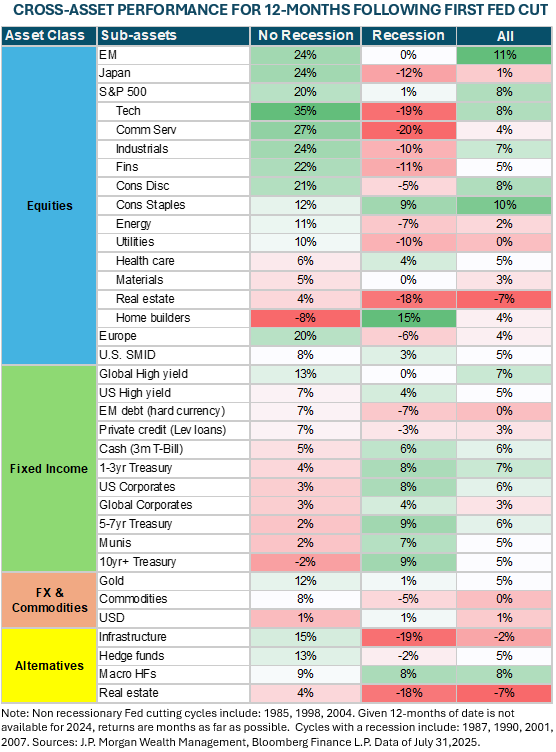

Rate cuts have historically influenced asset classes in very different ways depending on whether the economy ultimately slid into recession.

As Tyler Hardt, CFA, Chief Portfolio Manager, notes:

“Technology stocks, the strongest sector in the S&P 500, have historically returned 35% in the 12 months following a Fed cut if no recession materializes—but they have fallen 19% if a recession does occur.”

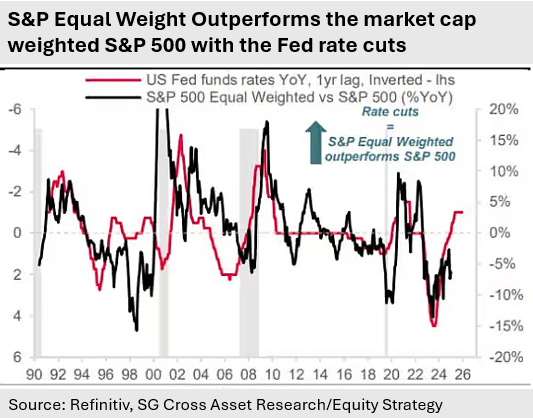

This bifurcation highlights the importance of staying diversified. If the economy avoids recession, investors may benefit from broadening market participation beyond the so-called “Magnificent Seven” mega-cap tech stocks. Historically, sectors like financials, industrials, and consumer cyclicals have gained momentum in rate-cutting cycles.

Hardt adds:

“One effect of the Fed lowering rates is that the performance of stocks has usually broadened out. We would expect more companies—particularly in financials, industrials, and consumer sectors—to participate in the rally.”

This environment aligns well with Moran’s diversified portfolio construction philosophy.

Are you not yet a client of Moran Wealth and wish to evaluate whether your portfolio is positioned to withstand the next stage of the cycle? Now is your chance. →

Fixed Income and Bond Markets

Bond yields, especially in the short-to-intermediate part of the curve, are likely to moderate as markets price in further cuts. Overnight money market yields will fall almost exactly in line with the Fed’s move.

But caution is warranted:

“Inflation expectations still being elevated is a risk—this could make long-term yields more volatile,” explains Chesebrough. “This will be a bigger topic of conversation and worry in 2026, in our opinion.”

Investors in fixed income should remain attuned to both credit quality and duration exposure as the cycle unfolds.

Inflation and Labor Market Risks

The Fed’s action was not just about inflation. Powell himself framed the cut as a “risk mitigation tool” in light of deteriorating labor market data. If unemployment worsens more than expected, further easing may follow.

At the same time, if inflation proves sticky, the Fed may slow or pause rate cuts altogether. The balancing act underscores why a long-term, disciplined investment strategy remains critical.

Key Takeaways

- The Fed cut rates by 25 basis points—less than some investors hoped.

- Historical performance following cuts depends heavily on whether a recession follows.

- Market leadership may broaden beyond mega-cap tech to financials, industrials, and consumer sectors.

- Bonds may see near-term yield relief, though long-term inflation risks persist.

- Households should expect modest shifts in borrowing and savings rates.

Our Perspective

At Moran Wealth Management®, we believe Fed decisions are important, but they are not destiny. Portfolios must be designed to weather multiple environments, whether rate cuts spark a broad rally or economic conditions deteriorate further.

The Fed’s actions are one variable in a much larger equation. Staying disciplined, diversified, and focused on long-term goals is the surest way to navigate uncertain times.